The Rise of Manufacturing in Nigeria: Trends and Opportunities

17 July, 2024

Nigeria, the most populous country in Africa, is experiencing a significant transformation in its manufacturing sector. While it was Africa's largest economy (source: nairametrics.com) in 2022, and second largest after Egypt in 2023, it is projected to slip to fourth place (source: bloomberg.com) due to a series of currency devaluations. However, the country remains a key player in the industrial growth of the continent and is already positioning itself for a renaissance.

The trends in its manufacturing sector, including key industries such as automotive, consumer goods, petrochemicals and pharmaceuticals, reveal new, diverse opportunities for local and international investors. Based on relevant data and projections, we explore how Nigeria's manufacturing landscape is evolving and what this means for the future.

The leading manufacturing sectors in Nigeria

Automotive

Driven by government initiatives and private sector investments, the Nigerian automotive industry has seen major growth in the last decade widely inaccessible since the height of the industry in the ‘70s. The National Automotive Industry Development Plan (NAIDP) has been pivotal to this, encouraging local assembly and production of vehicles.

Major international companies like Peugeot and Nissan have set up assembly plants in the country, creating jobs and boosting local capabilities. Indigenous auto-manufacturing companies have also sprung up, with Innoson Vehicle Manufacturing in Nnewi, Anambra; Nord Automobiles in Lekki, Lagos; and Phoenix Renewables which manufactures forward-thinking solar-powered vehicles in Maiduguri, Borno. Each company has fully functional assembly and production plants, and more are soon to follow.

A modern car assembly plant in Nigeria. Source: Construction Review Online (source: constructionreviewonline.com)

Consumer goods

Consumer goods manufacturing in Nigeria has faced significant challenges in the last year due to the ongoing currency crisis. The burgeoning middle class and increasing urbanisation had once driven demand for electronics, food and beverages. However, the economic instability has forced major companies like Unilever and Procter & Gamble to exit the country, creating a void in the market. This departure has increased reliance on imports and disrupted local economies that once thrived on the production and distribution of these goods as some local firms attempt to fill the gap.

With major players exiting the market, there is an opportunity for new entrants to capture the market share. The Nigerian government has introduced incentives to attract investment and stabilise the economy, including tax breaks, subsidies, Special Economic Zones (SEZs) and Free Trade Zones (FTZs) like the Lagos Free Zone. Policies favouring local production over imports have been strengthened, providing a more favourable environment for businesses setting up manufacturing operations within the country.

Chemicals and Petrochemicals

In 2023, Nigeria's chemicals and petrochemicals industry saw a production increase of approximately 12% compared to the previous year, reflecting an expansion in industrial activities and infrastructure projects. The Dangote Refinery, expected to be fully operational by 2024, will enhance local petrochemical production capacities significantly, reducing reliance on imports and stabilising the supply of essential raw materials for various manufacturing processes.

This underscores the sector's growth trajectory, driven by robust industrial activities and infrastructure development. For manufacturers, this means reduced costs and dependence on imported materials, enhancing competitiveness and operational efficiency. Investors can leverage the expanding petrochemical production capacity to explore new ventures in related industries, such as plastics, fertilizers and pharmaceuticals, which rely heavily on petrochemical inputs. The establishment of the Dangote Refinery is particularly crucial, as it promises to be a game-changer in the region, fostering a self-sustaining industrial ecosystem.

This development aligns with Nigeria's broader economic diversification goals and offers a strategic entry point for investors looking to tap into a burgeoning market with substantial growth potential and government backing.

Pharmaceuticals

The pharmaceutical sector, while currently facing challenges due to an over-reliance on imported products, is projected to experience significant growth in the coming years. The market value is expected to increase by 16% (source: statista.com) over the next five years, reaching approximately $2.3 billion by 2028 - 2029. This forecast is supported by government policies aimed at improving healthcare infrastructure and fostering local production, including a five-year ultimatum for international companies to move their production to Nigeria.

Despite economic volatility that may hamper consistent annual growth, initiatives from the government and support from the World Health Organization (WHO) are set to enhance the competitiveness of local manufacturers. By 2033, the Nigerian pharmaceutical industry is expected to be valued at around $4.1 billion, underscoring the sector's long-term potential and strategic importance in reducing dependency on imports and boosting local production capabilities.

In 2024, Swiss Pharma Nigeria Ltd., one of Nigeria’s local manufacturers, had its pediatric formulation pre-qualified by the WHO following a stringent evaluation of its manufacturing and quality control processes. Recent data from the National Agency for Food and Drug Administration and Control (NAFDAC) indicates that the number of local manufacturers increased by 12% (source: premiumtimesng.com) in 2023, highlighting the sector's resilience and potential to develop its manufacturing base, attract foreign investment and enhance its self-sufficiency in critical industrial sectors.

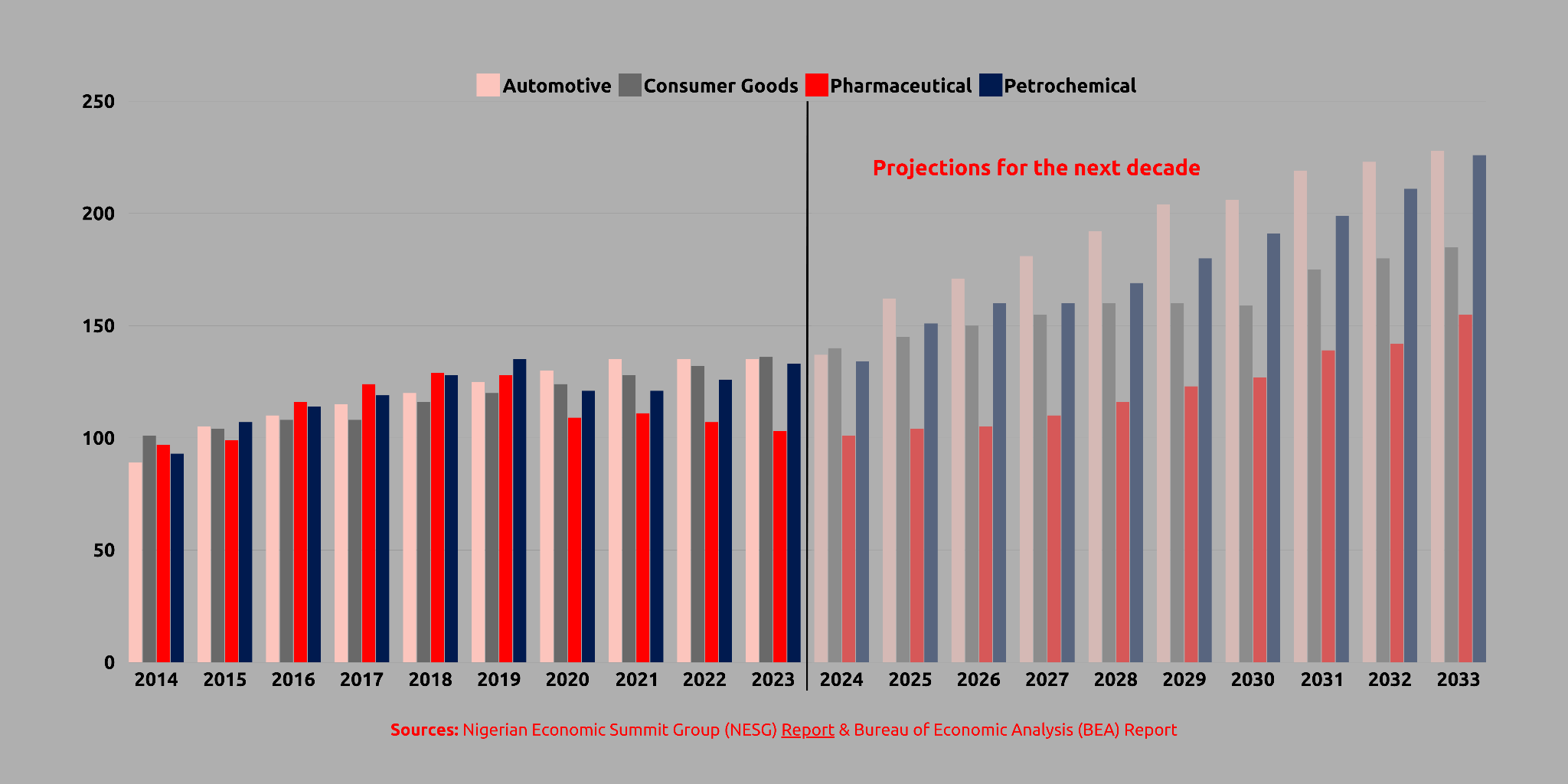

The growth in key manufacturing sector production and sales in Nigeria over the last decade illustrates an upward trend from 2014 to 2023, despite minor fluctuations

Opportunities for investors

The manufacturing sector in Nigeria presents numerous opportunities for local and international investors. With a large and young population, strategic location and abundant natural resources, Nigeria has long been an attractive destination for investment. There are even more tangible factors that make it desirable.

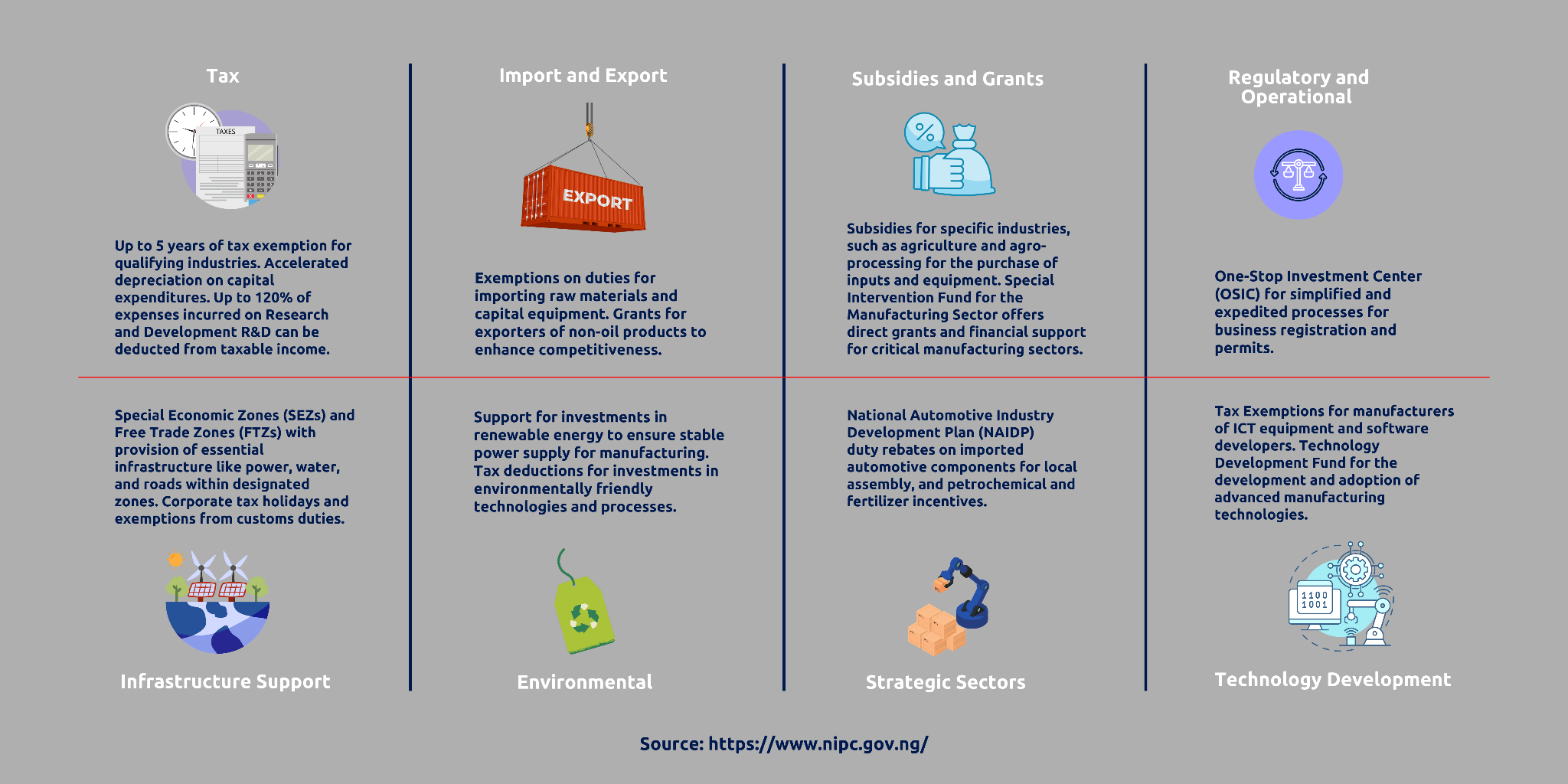

Government incentives

The Nigerian government offers several incentives to encourage investment in the manufacturing sector. The NAIDP, mentioned earlier, provides specific incentives for automotive manufacturers, while similar initiatives exist for other sectors. These include the Pioneer Status Incentive (PSI), which offers manufacturing companies a tax holiday of up to five years and accelerated capital allowances; and the Nigerian Investment Promotion Commission (NIPC), a one-stop shop for investors to reduce bureaucratic delays and streamline the process of starting a business in Nigeria.

Over the years, the Central Bank of Nigeria (CBN) has introduced policies designed to facilitate local manufacturing and foreign investment in the country. Power sector reforms provide a more reliable energy supply and offer special electricity tariffs for manufacturing companies to reduce operating costs. The Finance Act also provides value-added tax (VAT) exemptions on certain goods and services essential for manufacturing.

Opportunities for investors

The manufacturing sector in Nigeria presents numerous opportunities for local and international investors. With a large and young population, strategic location and abundant natural resources, Nigeria has long been an attractive destination for investment. There are even more tangible factors that make it desirable.

Government incentives

The Nigerian government offers several incentives to encourage investment in the manufacturing sector. The NAIDP, mentioned earlier, provides specific incentives for automotive manufacturers, while similar initiatives exist for other sectors. These include the Pioneer Status Incentive (PSI), which offers manufacturing companies a tax holiday of up to five years and accelerated capital allowances; and the Nigerian Investment Promotion Commission (NIPC), a one-stop shop for investors to reduce bureaucratic delays and streamline the process of starting a business in Nigeria.

Over the years, the Central Bank of Nigeria (CBN) has introduced policies designed to facilitate local manufacturing and foreign investment in the country. Power sector reforms provide a more reliable energy supply and offer special electricity tariffs for manufacturing companies to reduce operating costs. The Finance Act also provides value-added tax (VAT) exemptions on certain goods and services essential for manufacturing.

The government incentives available for manufacturing investments in Nigeria. Data Source: Nigerian Investment Promotion Commission (source: nipc.gov.ng)

Export hub

Emerging markets hold significant value for global investors and manufacturing companies due to their rapid economic growth, expanding consumer bases and increasingly favourable investment climates. Nigeria presents a higher growth potential than most developed economies, with substantial opportunities as a regional hub for export, offering opportunities to global investors for diversification, higher returns and access to untapped sectors in the region.

Sub-Saharan Africa, like Southeast Asia and Latin America, has seen a substantial inflow of foreign direct investment (FDI), with Nigeria becoming a key destination for manufacturing industries in the last decade. Situated along the West African coast, Nigeria offers direct access to major Atlantic shipping routes, facilitating trade within West Africa and globally. Government policies, such as the Nigerian Export Promotion Council (NEPC) initiatives, support exporters by reducing trade barriers and providing access to broader markets.

For manufacturing companies, emerging markets provide several advantages, including lower labour costs, abundant natural resources and favourable government policies aimed at attracting foreign investment. As the economy develops, there is a growing demand for even more infrastructure and technological advancement, creating a broad spectrum of opportunities for businesses across sectors. By tapping into this market, global manufacturing companies can benefit from Nigeria's strategic location and regional influence that make it the ideal regional export hub to scale operations to meet global demands.

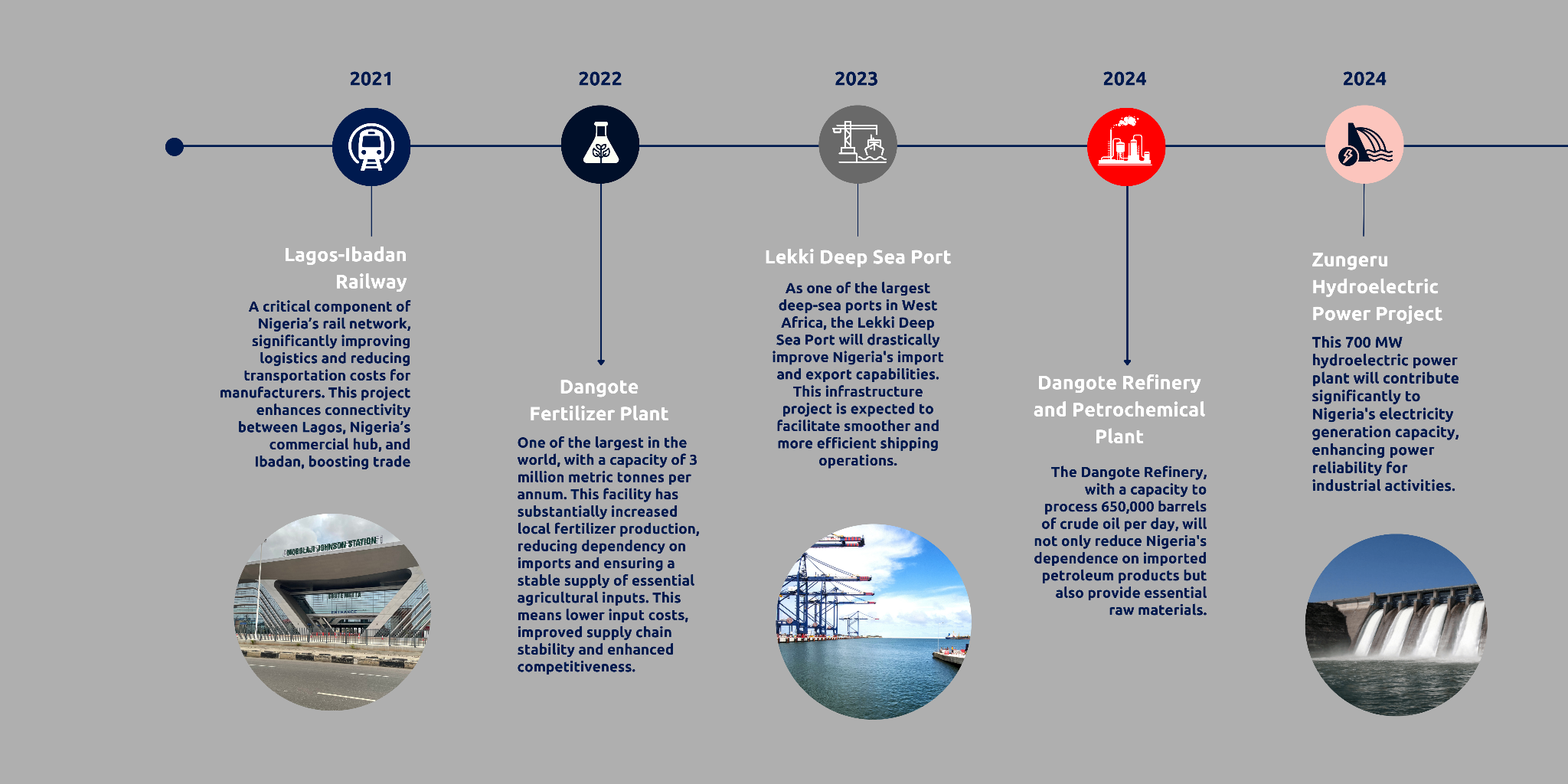

Infrastructural development

Significant investments are being made in infrastructure development, which is critical for the manufacturing sector. With multiple trade zone projects and the addition and expansion of ports, Nigeria's logistics and trade capabilities are on a steady growth trajectory. Improved infrastructure reduces production costs and enhances the efficiency of supply chains, making Nigeria more competitive.

A timeline of major infrastructure projects in Nigeria, highlighting their expected completion dates and impact on the manufacturing sector

These projects represent significant investments in Nigeria's infrastructure, each contributing to the enhancement of the manufacturing sector by improving logistics, reducing operational costs and providing reliable power supply. These improvements are expected to attract more investments and drive industrial growth in Nigeria.

Skilled workforce

Nigeria boasts a large, young and increasingly skilled workforce. Educational institutions and vocational training centres are focusing on equipping the youth with the skills needed for modern manufacturing. This growing pool of talent is an asset for investors looking to establish or expand manufacturing operations in Nigeria.

As of 2023, Nigeria's total labour force is estimated at approximately 75.5 million people. This includes skilled and unskilled workers across various sectors of the economy. The manufacturing sector contributes to about 11.4% of formal sector employment in Nigeria. This translates to a significant portion of the labour force involved in manufacturing. To meet the demand, there is an increasing number of technical schools and vocational education programs available to equip young people with the relevant skills.

Young Nigerian workers receive training organised by SSATVEE and Yikodeen Factory, Lagos. Source: NAN News (source: nannews.ng)

Regional integration

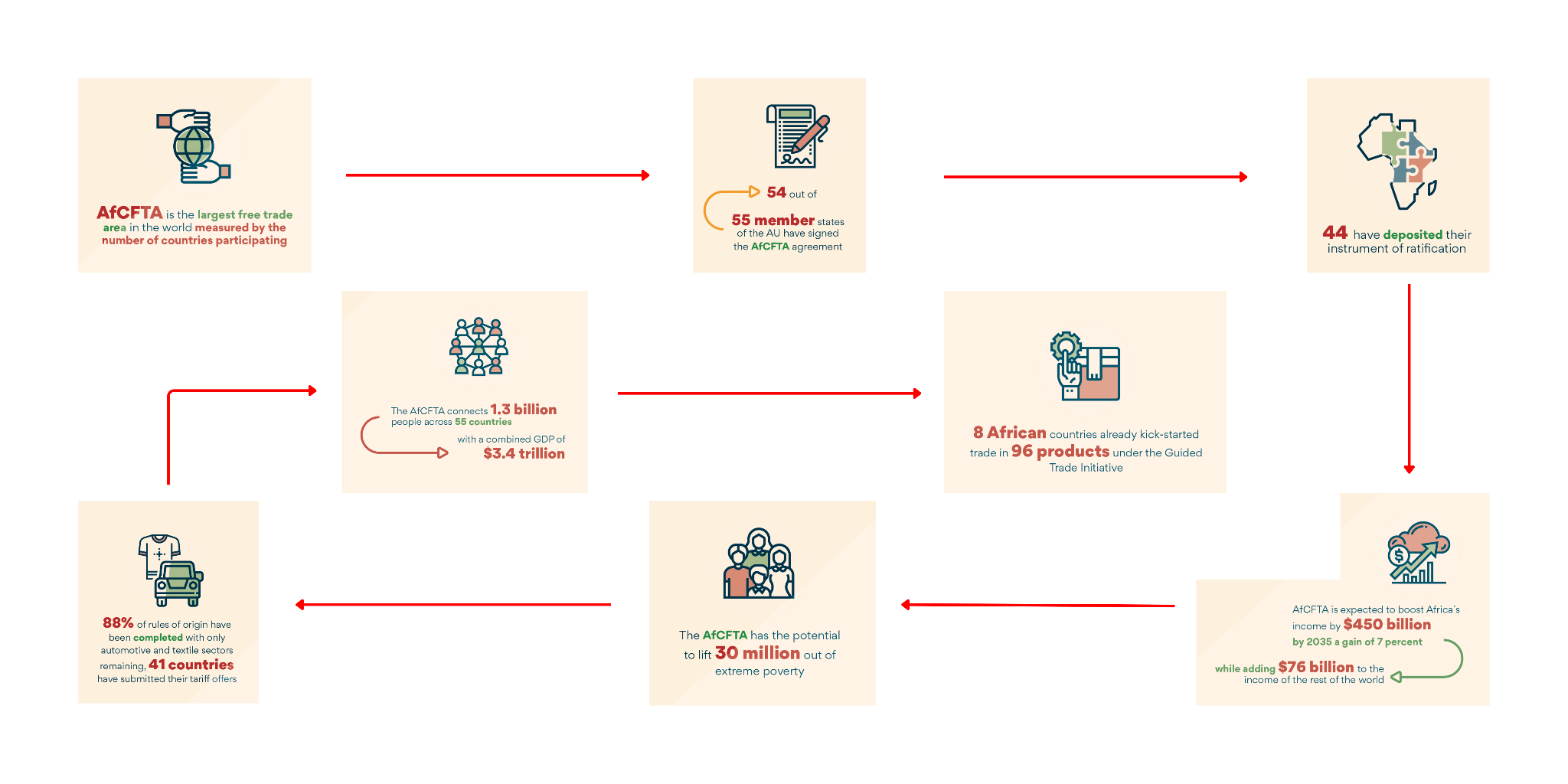

Nigeria’s manufacturing growth is a catalyst for broader industrial growth in West Africa. As the region's largest economy, Nigeria's advancements have a spillover effect on neighbouring countries, fostering a more integrated regional industrial sector. The African Continental Free Trade Area (AfCFTA) (source: cbn.gov.ng) agreement, which Nigeria is a part of, is a significant driver of regional industrial growth. By reducing trade barriers and tariffs among member states, AfCFTA aims to create a single continental market for goods and services, enhancing industrial collaboration and competition.

This integration is expected to stimulate industrial activities across West Africa, with Nigeria playing a central role. Countries like Ghana, Ivory Coast and Senegal are also seeing growth in various manufacturing sectors. Ghana, for instance, is focusing on agro-processing, while Ivory Coast is boosting its cocoa processing capabilities.

Cocoa processing plant in Ivory Coast

As regional trade increases, Nigerian manufacturers can benefit from expanded market access, reduced costs and increased efficiencies. The agreement also allows Nigerian businesses to source raw materials and intermediate goods from neighbouring countries at lower costs, thus boosting production capabilities.

For investors, this presents a dual benefit: the ability to tap into Nigeria’s robust market while leveraging regional supply chains and market access facilitated by AfCFTA. This environment fosters an industrial landscape that makes Nigeria an ideal entry point for those looking to invest in the burgeoning West African manufacturing sector.

Quick facts about AfCFTA. Data Source: AfCFTA Fact Sheet (source: au-afcfta.org)

With the right mix of government policies, private sector initiatives and regional cooperation, Nigeria is on a path to becoming a manufacturing powerhouse in West Africa. The opportunities for local and international investors are vast, supported by a growing market, improving infrastructure and a large workforce. While challenges exist, the ongoing reforms and investments are setting the stage for sustained industrial growth.

By understanding and leveraging the trends and opportunities in Nigeria's manufacturing sector, investors can contribute to and benefit from the country's economic transformation, driving industrial growth across West Africa.