The Impact of Trade Policies on Nigeria’s Manufacturing Sector

05 November, 2024

The Nigerian manufacturing sector is an essential pillar of the nation's economy, and an intricate web of trade policies has long shaped it. These policies, while aimed at fostering economic growth and stability, have had varying degrees of success in boosting industrial development.

Understanding the dynamics of trade in Nigeria, is crucial to tapping into the vast opportunities the country offers. Furthermore, strategic investments in special economic zones like the Lagos Free Zone (LFZ), help demystify the complexities and streamline the bottlenecks to the benefit of investors.

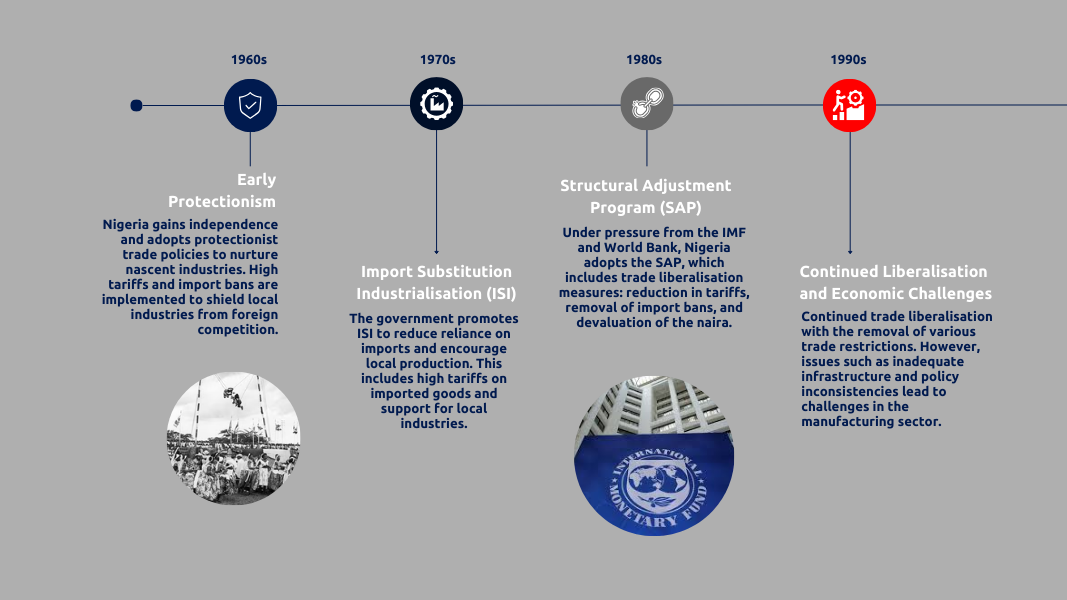

A historical overview of trade policies

A timeline of key trade policy changes in Nigeria from the 1960s to the present, highlighting major policy shifts

Nigeria's trade policies have evolved significantly since independence in 1960. Initially, the government adopted protectionist policies to shield nascent industries from foreign competition. These policies included high tariffs, import bans, and the promotion of Import Substitution Industrialisation (source: investopedia.com) (ISI). While these measures were intended to stimulate local production, they often led to inefficiencies and stunted growth, as many industries became dependent on government protection rather than innovation and competitiveness.

The Structural Adjustment Program (SAP) (source: dc.cbn.gov.ng) of the 1980s marked a turning point. Under pressure from the International Monetary Fund (IMF) and World Bank, Nigeria embraced trade liberalisation, reducing tariffs, removing import bans, and devaluing the naira. This shift was supposed to integrate Nigeria into the global economy, attract foreign direct investment (FDI), and promote export-led growth. However, the rapid liberalisation, coupled with a lack of supporting infrastructure and policy frameworks, resulted in the collapse of many local industries that could not compete with cheaper, imported goods.

In recent years, Nigeria has oscillated between protectionism and liberalisation, reflecting the ongoing debate over the best approach to industrialisation. The Economic Recovery and Growth Plan (ERGP) (source: statehouse.gov.ng) of 2017 to 2020, for example, emphasised the need to diversify the economy away from oil dependency by boosting manufacturing and exports.

Current trade policies and their impact

Nigeria's trade policies are characterised by a blend of protectionist measures and incentives aimed at supporting the manufacturing sector. The Central Bank of Nigeria (CBN) has implemented several policies to restrict the importation of goods that can be produced locally, such as the "41 items" ban (source:.trade.gov), which prohibited access to foreign exchange for the importation of certain goods from June 2015 until 2023.

This policy was designed to stimulate local production in sectors such as cement, food and beverage, and textiles.For instance, Nigeria's cement production capacity increased from two million metric tons per annum in 2002 to over 40 million metric tons in 2020, with local companies like Lafarge, Ibeto, BUA and Dangote Cement leading the charge. On the other hand, the restrictions led to smuggling of banned goods and increased production costs for manufacturers reliant on imported raw materials. In October 2023, the CBN lifted the ban (source: tanbicibtcbank.com), signalling a shift in trade policy. The policy change is expected to lower production costs for many manufacturers, who previously faced increased operational expenses due to limited access to imported inputs.

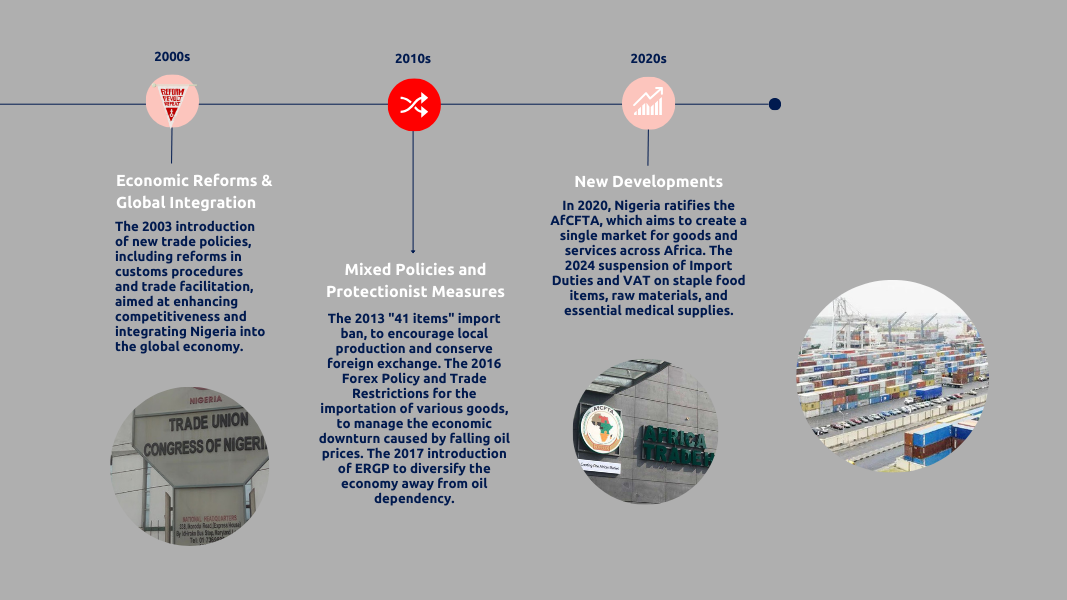

Furthermore, Nigeria's membership in the African Continental Free Trade Area (AfCFTA) (source: au.int) presents opportunities. While AfCFTA aims to create a single market for goods and services across Africa, boosting Intra-African trade, it also exposes Nigerian manufacturers to increased competition from more industrialised African economies. The success of Nigeria's manufacturing sector under AfCFTA therefore depends on the government's ability to implement supportive policies that enhance local competitiveness and productivity.

A strategic hub for investors

Understanding these trade patterns, the Lagos Free Zone (LFZ) presents opportunities for investors looking to explore Nigeria's manufacturing potential. Nigeria's first private-owned free trade zone, promoted by Tolaram (source: tolaram.com), LFZ spans over 850 hectares and is a self-sustained ecosystem for ease of doing business, with state-of-the-art infrastructure, efficient logistics, and streamlined regulatory processes.

Investors at LFZ benefit from tax holidays, duty-free imports of raw materials and equipment, and unrestricted repatriation of profits, providing a level of financial security and flexibility that is crucial for companies operating in Nigeria's dynamic economic environment. The Nigeria Export Processing Zones Act (NEPZA) of 1992 clearly outlines the conditions for operating within the free zone, offering transparency and clarity for investors. This legislation demystifies the regulatory framework, ensuring businesses understand their rights and obligations, which helps streamline the decision-making process for companies looking to set up operations in the Zone.

In addition to the legal clarity provided by NEPZA, the Zone offers a simplified Customs process, which reduces bureaucratic delays and eases the complexities associated with trade policy compliance. This operational efficiency accelerates the movement of goods in and out of the Zone, enabling manufacturers to meet production timelines and market demands more efficiently. Operating within the well-regulated framework of the Lagos Free Zone gives businesses a competitive edge in navigating Nigeria’s trade policies and maximising profitability.

LFZ's integrated approach to industrial development addresses many of the challenges faced by manufacturers in Nigeria, providing a conducive environment with world-class infrastructure, reliable energy, integration with the Lekki Deep Sea Port and simplified regulatory processes. LFZ also provides a single window for all regulatory approvals, including business registration, permits, and licences. This centralised system reduces the administrative burden on investors and ensures quicker compliance with Nigerian trade and business regulations.The one-stop-shop ecosystem also helps investors easily navigate and take advantage of regional trade policies such as the African Growth and Opportunity Act (AGOA) (source: ustr.gov), Generalised System of Preferences (GSP), AfCFTA and others.

The Zone operates under a legal framework that protects investors' rights, ensuring that investments are secure even in the face of changing trade policies. This legal certainty is vital for international investors who may be concerned about policy stability. LFZ has designated clusters, providing tailored support that align with Nigeria’s industrial policy to its target industries including Fast-Moving Consumer Goods (FMCG), automotive, chemicals, non-metallic minerals, paper, pharmaceuticals, and downstream petrochemicals.

Lagos Free Zone Site Layout | Source: Lagos Free Zone

Industry case studies

Below are the effects of trade policies on three key industries in Nigeria.

Pharmaceutical Industry

Nigeria's pharmaceutical industry has significant growth potential, driven by the population of 200+ million and an increasing demand for healthcare products. LFZ offers an ideal location for pharmaceutical companies to establish manufacturing plants, benefiting from the Zone's ready to use infrastructure and incentives while addressing the critical need for local production of essential medicines

The Zone supports pharmaceutical companies in maintaining Good Manufacturing Practices (GMP) (source: who.int) by providing an environment in line with international standards. This is critical for companies looking to export to stringent markets like the EU or US, where compliance with global standards is non-negotiable.

Automotive Industry

Large companies in the automotive industry significantly benefit from establishing local production facilities to serve both the Nigerian market and the broader West African region. By creating a local source for their products, these companies reduce dependence on imports, lower production costs, and more efficiently meet the demand in local and regional markets, enhancing supply chain resilience and tapping into the region’s growing economic potential.

The automotive industry in Nigeria has the potential to become a major driver of economic growth, creating jobs and fostering technological innovation. Import duties on automotive components can range from 10% to 35% (source: taxsummaries.pwc.com). Automotive companies in the LFZ can benefit from duty-free importation of completely knocked down (CKD) kits and spare parts. Operating within the LFZ allows vehicle manufacturers to avoid paying a lump sum for these duties upfront; in the Zone, Customs duties are paid at the point of sales, giving the companies a working capital benefit.

Automotive manufacturers in the Zone enjoy corporate income tax holidays. Given Nigeria's corporate tax rate of 30% (source:taxsummaries.pwc.com), this represents substantial savings. For instance, a company generating $1 billion in revenue could save $300 million per annum.

Automotive companies at LFZ could also benefit from expedited Customs procedures. A typical clearance process that might take 14 days at traditional Nigerian ports could be reduced to just two days thanks to the Lagos Free Zone and integrated Lekki Port ecosystem. Faster Customs clearance enables these companies to maintain predictable production cycles, minimising downtime and inventory holding costs.

Food and Beverage (F&B) Industry

The LFZ hosts major F&B manufacturers, including Kellogg's, Power Oil and Dano Milk (source: theafricareport.com), who are capitalising on Nigeria's large and growing consumer market. By producing locally, these companies can reduce costs, respond quickly to market trends, and increase their market share, while also contributing to the development of local supply chains.

Power Oil Factory inside Lagos Free Zone

F&Bs operating at the Lagos Free Zone can import raw materials, packaging, and production machinery duty-free. Import duties on raw materials in Nigeria can range from 5% to 20%, depending on the product. Like the automotives industry, operating within the LFZ allows F&B companies to enjoy a delayed duty payment arrangement.

Lagos Free Zone’s integration with Lekki Deep Sea Port—designed to handle 1.2 million TEUs annually (source: ice.org.uk) reduces logistics and shipping costs. For F&B manufacturers, reduced transit times are crucial for maintaining the freshness of perishable goods. The cost of importing ingredients and exporting finished products can improve overall supply chain efficiency by up to 40%.

With Nigeria’s participation in the AfCFTA, F&Bs at LFZ can export products to other African countries with reduced tariffs. This opens a market of over 1.3 billion people. By leveraging LFZ’s duty-free status and the AfCFTA’s reduced tariffs, a manufacturer can increase their export margins significantly boosting revenue and market presence across Africa.

Navigating trade policies for sustainable growth

The future of Nigeria's manufacturing sector depends on the government's ability to craft and implement trade policies that strike a balance. Positive moves have already been made. In June 2024, import duty and other tariffs on staple food items, raw materials and other direct inputs used for manufacturing, inputs for agriculture production including fertilisers, seedlings, chemicals, pharmaceutical products, poultry feeds, flour and grains were suspended for six months (source: dailypost.ng); value added tax on the items were also suspended for the rest of the year.

Weeks later, President Tinubu signed an executive order to suspend (source:businessday.ng) import duties and value-added tax on essential medical supplies imported into the country. The order introduced zero tariffs, excise duties and VAT on specified machinery, equipment and raw materials, aiming to reduce production costs and enhance local manufacturers’ competitiveness. This was in line with the Initiative for Unlocking the Healthcare Value Chain (source: nafdac.gov.ng) approved in October 2023. This presidential initiative aims to attract new substantial investment into Nigeria’s healthcare system, stimulate local manufacturing, reduce drug costs, and implement other transformative measures in the pharmaceutical industry.

Nigeria's trade policies have had a profound impact on the manufacturing sector, and the Lagos Free Zone offers easy access for prospects interested in the opportunities. By leveraging the Zone's advantages, investors can navigate the trade policies and capitalise on the opportunities presented by Nigeria's growing market.