Investment Opportunities in West Africa's Emerging Industries

10 September, 2024

West Africa, a region known for its rich cultural diversity and natural resources, is fast becoming a hotspot for emerging industries (source: investopedia.com). As the global economy shifts and evolves, investors increasingly consider West Africa a fertile ground for new opportunities. While traditional sectors like agriculture and service businesses have historically been at the forefront, the region's manufacturing sector is taking centre stage in recent times.

The African Economic Outlook 2024 (source: afdb.org) highlights Africa's potential for growth in emerging sectors due to increasing investments, favourable policies and a growing talent pool. As with the rest of the continent, West Africa is experiencing a transformative phase in its industrial landscape, driven primarily by technology and advanced infrastructure. These factors not only foster economic growth but also position the region as a hub for innovation and sustainability.

Explore Nigeria’s emerging industries, leveraging the strategic role of the Lagos Free Zone. This guide covers past trends, current developments, market potential, returns, and the regulatory landscape to help investors navigate opportunities.

Aerial view of a factory in the Lagos Free Zone | Source: LinkedIn (source: linkedin.com)

Nigeria: A case study

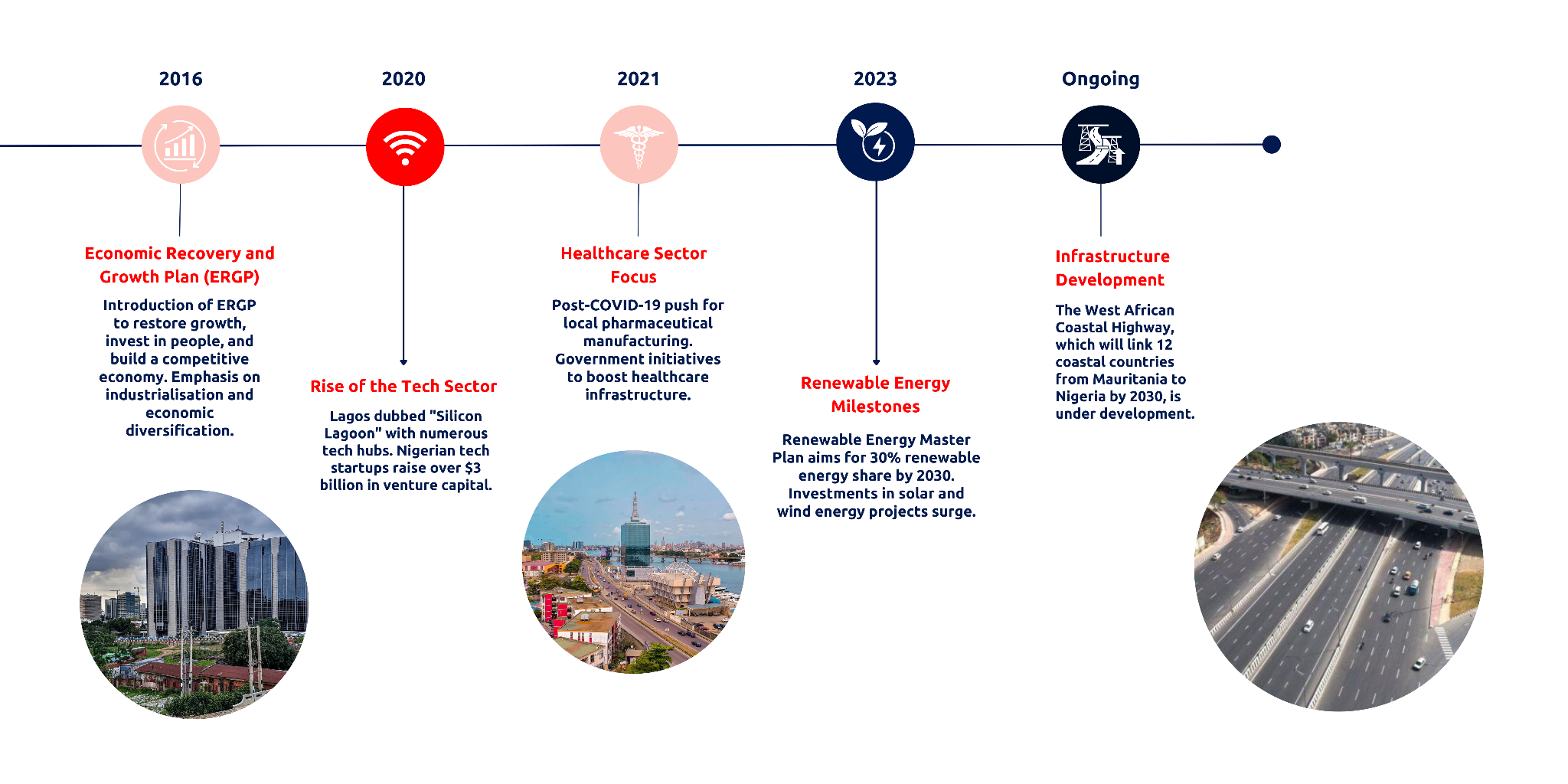

Nigeria is a top choice for investors in West Africa's growing manufacturing sector. It offers easy access to other West African markets and plays a key role in the Economic Community of West African States (ECOWAS), (source: state.gov) making it a central hub for regional trade. With a population of 218 million people as of 2022, Nigeria presents a vast consumer market, with a growing middle class and youth population boosting the demand for manufactured goods and associated services.

Past investment trends in Nigeria

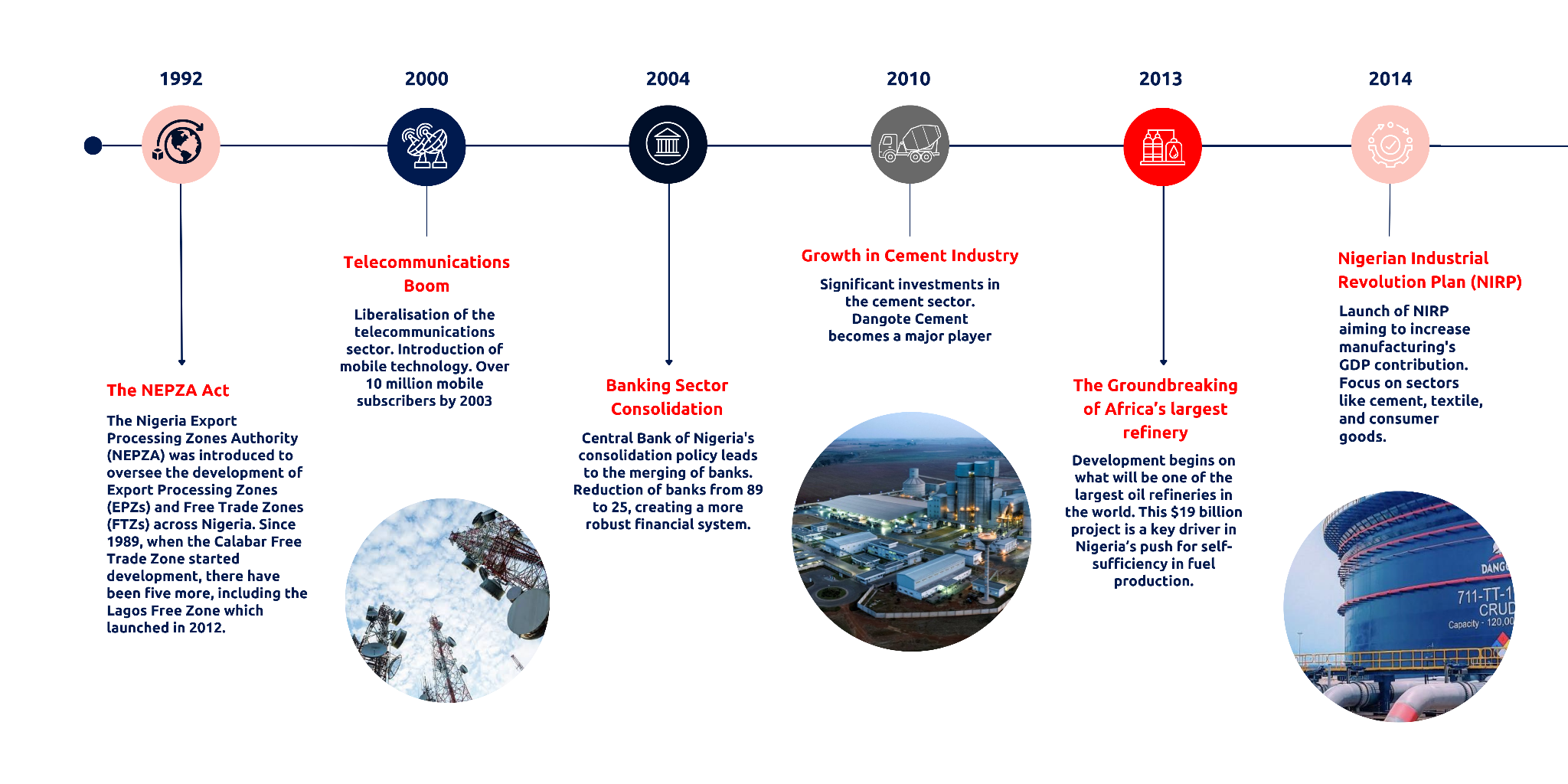

A timeline of major milestones in Nigeria's economic diversification efforts, including the introduction of NEPZA and ERGP

Nigeria's economy has been heavily reliant on oil and gas, which accounts for approximately 90% of its export earnings and 60% of government revenue. This dependency has made the economy vulnerable to global oil and gas price fluctuations. As a result of this, the Federal government has a mandate to diversify the economy and reduce reliance on oil and gas.

From 2000 to 2010, Nigeria saw substantial growth in the telecommunications sector, driven by its liberalisation and democratisation, and the subsequent introduction of mobile technology. The sector grew from virtually non-existent to one of the largest in Africa, with over 200 million subscribers by 2020. Similarly, the banking sector underwent consolidation and reforms, resulting in the robust and resilient financial system that exists today.

The early 2000s also marked a period of resurgence for Nigeria's manufacturing sector. The cement industry saw substantial investment, with companies like Dangote Cement, Ibeto, BUA group (to name a few) becoming major players in the sector. The boom in real estate and infrastructure development supported this growth.

Renewed interest in the automotive sector also led to the establishment of new assembly plants and partnerships with global automotive brands. In 2014, the Nigerian government introduced the National Automotive Policy, to boost local vehicle manufacturing by providing import duties on completely built-up (CBU) vehicles and supporting local assembly plants. This policy was a significant driver for investment in the sector, attracting global automotive brands, like Peugeot Automobile Nigeria (PAN) and Stallion Group, to establish new assembly plants and partnerships.

Current investment climate

Launched in 2014, the Nigerian Industrial Revolution Plan (NIRP) (source: nirpproject.org) aims to increase the contribution of manufacturing to GDP, create jobs and enhance the global competitiveness of Nigerian products. The Economic Recovery and Growth Plan (ERGP) (source: statehouse.gov.ng) was later launched in 2017 to guide Nigeria's economic policy and development efforts for the next four years, focusing on restoring growth with manufacturing as a leading success driver. The ERGP played a key role in stabilising Nigeria's economy following the 2016 recession (source: tandfonline.com). By 2018, the country saw a return to positive GDP growth, driven by efforts in economic diversification and improved fiscal policies.

Nigeria has made strides in creating a more conducive environment for investment. The Nigeria Export Processing Zones Authority (NEPZA) (source: nepza.gov.ng) has been at the forefront of these efforts, managing and overseeing the development of Export Processing Zones (EPZs) and Free Trade Zones (FTZs) across Nigeria. These Zones provide a business-friendly environment with special incentives, minimal bureaucratic hurdles and infrastructure tailored to attract foreign and local investments.

As Nigeria continues its journey towards economic diversification and industrialisation, the manufacturing sector remains a vital component. With an estimated GDP of $1.277 trillion (source: .worldeconomics.com) at the end of 2023 in purchasing power parity terms, Nigeria is on an upward trajectory with potential for substantial growth.

Map of Nigeria showing area with the largest influx of investments and highest safety standards

Key emerging industries

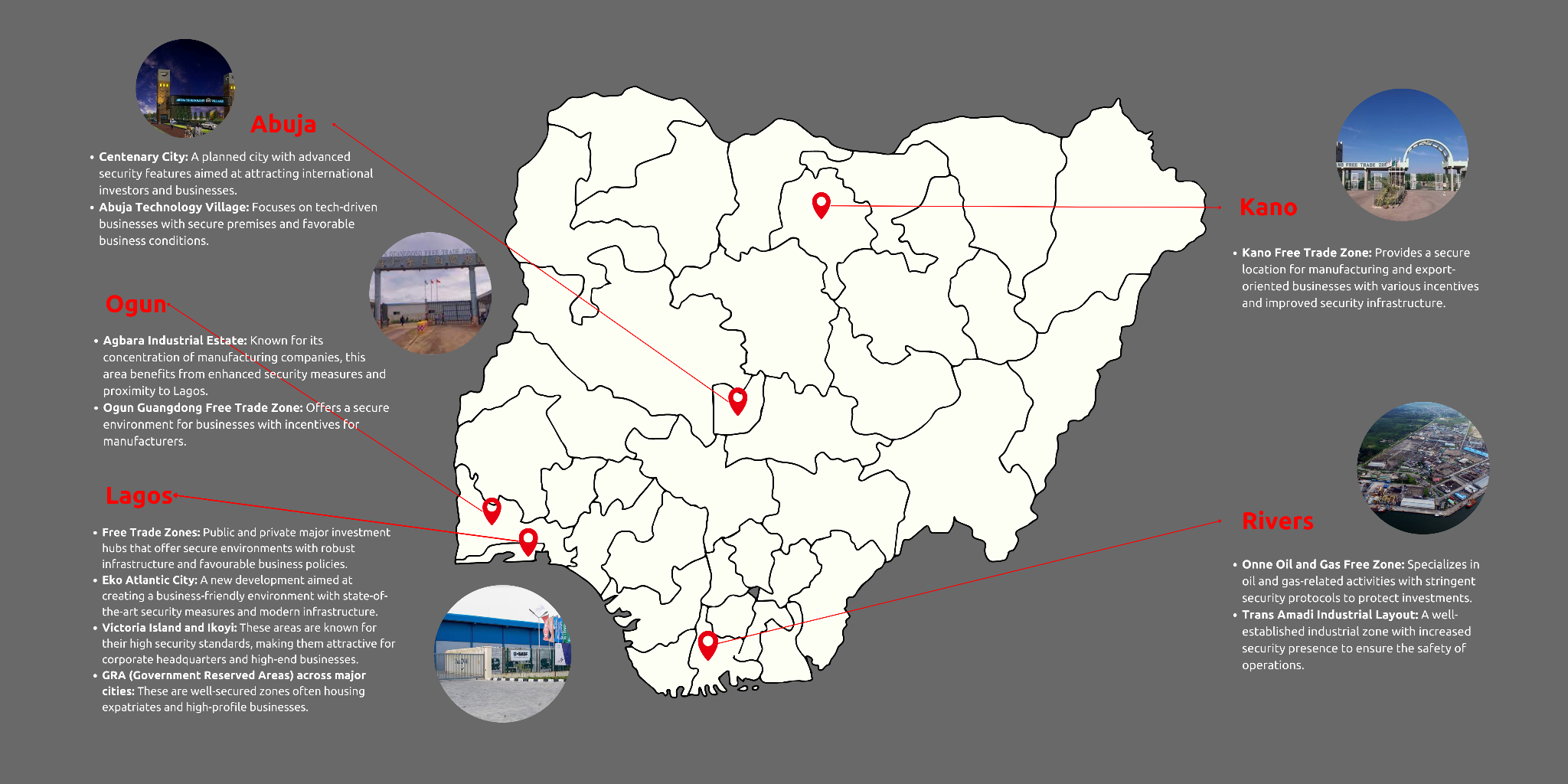

Technology

Nigeria's tech ecosystem fondly referred to as the "Silicon Lagoon”, is one of the fastest-growing in Africa. Lagos, the commercial capital, is home to numerous tech hubs, startups and incubators. Companies like Flutterwave, Andela and Paystack have gained international recognition, attracting significant venture capital investments. According to Partech (source: partechpartners.com), African tech startups raised $5.2 billion in 2021, with Nigeria accounting for over 60% of this amount. The ecosystem, led by hubs like Co-Creation Hub (source: cchub.africa) (CcHub), founded in 2010 by Bosun Tijani, the current Minister of Communications, Innovation and Digital Economy of Nigeria, fosters startups that develop solutions for diverse industries.

UK’s Minister of International Development (DFID) visits CcHUB in 2016. Source: Co-Creation Hub (source: cchub.africa)

Lagos Free Zone, a private special economic zone, offers a unique opportunity to further develop tech hubs, through a dedicated cluster for innovation and digital entrepreneurship. By providing ready-to-use infrastructure, such as high-speed internet connectivity, reliable power solutions, business friendly policies and flexible office spaces, LFZ is designed to cater to growth seeking tech companies.

Manufacturing

The manufacturing sector in Nigeria has become a key focus in the country's efforts to diversify its economy, contributing 13% of GDP as of 2022. This resurgence is driven by strategic government policies such as the establishment of Special Economic Zones (SEZs), designed to attract Foreign Direct Investment (FDI) and boost exports.

The Lagos Free Zone (LFZ), for instance, is part of a broader initiative to scale up manufacturing, offering businesses a competitive edge through streamlined customs processes and improved infrastructure. Integrated with the Lekki Deep Sea Port (source: lekkiport.com), LFZ is expected to handle up to 1.2 million TEUs annually, reducing logistics costs by 15-20% and improving access to both local and international markets. This development reflects Nigeria’s growing role as a manufacturing hub, attracting over $10 billion in investment commitments across multiple industries.

Chapel Hill Denham and Commonwealth Enterprise and Investment Council (CWEIC) tour Lekki Port at Lagos Free Zone facilities in 2023 | Source: CWEIC (source: cweic.org)

Healthcare

The healthcare sector experienced its own resurgence due to the 2020 COVID-19 pandemic, which highlighted the imminent need for improved healthcare infrastructure in the country. Over the years, the government has implemented policies and legislative measures to support pharmaceutical growth. Key among these is the National Drug Policy (NDP) (source" cdn.who.int), which was first introduced in 1990 and revised in 2005, to ensure the availability, accessibility, and affordability of essential medicines, with a strong emphasis on promoting local production.

The Nigerian Content Development and Monitoring Board (NCDMB) (source: ncdmb.gov.ng) has also actively promoted local manufacturing in the pharmaceutical sector in line with the NDP, ensuring that a great percentage of pharmaceuticals consumed in Nigeria are produced locally. This policy is further supported by the National Health Act of 2014 (source: ncbi.nlm.nih.gov), which created a framework for the regulation, development, and management of the national health system, and mandates the inclusion of locally produced pharmaceuticals in public procurement processes.

President Muhammadu Buhari signed the Executive Order 003 (source: gazettes.africa) in 2017, to mandate all Ministries, Departments and Agencies (MDAs) to give preference to local manufacturers of pharmaceuticals and medical supplies in their procurement processes. Several companies, including Fidson Healthcare Plc, have taken advantage of these policies to establish and expand their operations. The leading Nigerian pharmaceutical company built a world-class manufacturing facility in Ogun State, which produces a wide range of pharmaceutical products, including antimalarials, antibiotics, and antiretrovirals.

Biovaccines Nigeria Limited, a joint venture between the Federal Government and May & Baker Nigeria Plc to revive local vaccine production (source: nairametrics.com), is working on vaccines for diseases like yellow fever and measles, with plans to expand into other vaccines. This initiative is critical to reducing Nigeria's dependence on imported vaccines and addressing local health challenges.

As Nigeria continues to push for self-sufficiency in healthcare, the pharmaceutical sector remains a promising area for investment, with a growing local market.

Renewable energy

Nigeria’s abundant solar and wind resources make it ideal for renewable energy projects. The Renewable Energy Master Plan (source: iea.org) aims to increase the share of renewable energy in the country’s energy mix from 19% in 2023 to 30% by 2030.

To achieve this, there is a growing emphasis on manufacturing solar panels, wind turbines and other renewable energy components locally. Companies like Lumos Nigeria and Rubitec Solar are leading the way in solar energy device and component manufacturing, creating jobs and fostering local expertise.

REA officials installing solar panels in Makoko, Lagos. Source: Rural Electrification Agency

LFZ supports this emerging sector with pre-built factories that are custom-tailored for seamless manufacturing assembly. These state-of-the-art facilities are designed to expedite the setup process, allowing companies to start production with minimal delay—particularly advantageous for manufacturing companies looking to scale operations quickly.

Consumer electronics

The consumer electronics market in West Africa is growing rapidly, fueled by a tech-savvy population, and Nigeria is emerging as a hub for electronic manufacturing and assembly. The establishment of the Nigerian Electronics Development Institute (NEDI) has been pivotal in fostering local innovation and production.

Companies like RLG Communications, an ICT company with headquarters in Dubai-United Arab Emirates, have set up assembly plants in Nigeria (source: /rlg.ng), producing a range of electronic devices from mobile phones to computers. This local production not only meets the growing domestic demand but also positions Nigeria as a potential exporter of electronics within the region.

Key market trends driving growth in West Africa's emerging manufacturing sector

Final thoughts

As West Africa's largest economy, Nigeria’s growth trajectory significantly influences the region, cementing it as a key player in its economic transformation. Nigeria's emerging industries present a robust investment landscape with value ranging from $47 billion to $68 billion across the key sectors. With the right partnerships and infrastructural support, through initiatives like the Lagos Free Zone, focusing on these emerging industries will not only bring substantial financial returns but also contribute to the sustainable economic growth of West Africa.